are union dues tax deductible in 2020

And they lost a tax break in last years tax reform bill. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Your 2020 Guide To Tax Deductions The Motley Fool

The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues equivalents as a condition of employment.

. To enter your union dues for work performed as an employee W-2. That would be fun to explain to a programmer. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

Completing your tax return Claim on line 21200 of your return the amount shown in box 44 of all of your T4 slips or the amount shown on all your receipts. Politicians and the public tend to view them unfavorably. For the industry you work in you can claim a deduction for.

Union dues may be tax deductible subject to certain limitations. However neither spouse can deduct more than 250 of his or her qualified expenses. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions.

However the job-related expenses deduction is still available to people who work in one of these specific professions or situations. If you and your spouse are filing jointly and both of you were eligible educators the maximum deduction is 500. If you are self-employed you can enter your union dues as a Schedule C business expense.

Most union employees are on dues checkoff. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. The deduction is above the line meaning filers can exclude the cost of dues from their.

Miscellaneous itemized deductions are those. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. Tax reform changed the rules of union due deductions.

The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. But theres a faint light for unionized workers thanks to a bill to restore their dues deduction and make the expense easier. Union fees subscriptions to trade business or professional associations the payment of a bargaining agents fee to a union for negotiations in relation to a new enterprise agreement award with your existing employer.

Educator expense tax deduction renewed for 2020 tax returns Eligible educators can deduct up to 250 of qualified expenses you paid in 2020. Membership in the workplace organizations has at best stalled. And yes the clergy do have unions in Great Britain and Canada.

The payments are a required wage deduction under an agency shop agreement. There are however a few exceptions and if your union dues meet one of the exceptions listed below you are in luck. Union Dues or Professional Membership Dues You Cannot Claim You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company.

However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. This prohibition was written into the tax reform legislation passed by the US. Job-related expenses arent fully deductible as they are subject to the 2 rule.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. The payments are a condition of continued membership in a union and membership is related directly to your present job. How are dues typically paid.

Labor Day 2018 doesnt bring much good news for unions. The good news is that there are exceptions in which you can deduct union dues. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

Furthermore you cannot claim a tax deduction for paying membership dues as a member of a pension plan. Tax reform eliminated the deduction for union dues for tax years 2018-2025. Expenses You Cant Deduct Miscellaneous Deductions Subject to the 2 AGI Limit Appraisal Fees Casualty and Theft Losses Clerical Help and Office Rent Credit or Debit Card Convenience Fees Depreciation on Home Computer Fees To Collect Interest and Dividends Fines or Penalties Hobby Expenses Indirect Deductions of Pass-Through Entities.

If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. Are union dues tax deductible 2020. What union dues are deductible.

Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense. Dues are deducted directly from each paycheck and sent by the employer directly to the union office. Under current federal law employee business expenses are generally not deductible.

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. Union dues National Labor Relations Board Skip to main content. Not sure about this country yet.

The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills. That is the deductibility has been suspended for tax years 2018 through 2025 inclusive. You may be eligible for a rebate of any GSTHST that you paid as part of your dues.

Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax. Tax reform eliminated the deduction for union dues for tax years 2018-2025. Dues arent deducted until the worker signs paperwork that authorizes dues deduction and elects membership or fee paying status.

Miscellaneous itemized deductions are those. Employee business expenses are currently not tax-deductible under current federal law as the ability to deduct these expenses has been suspended starting in 2018 and running until 2025. During the year ending Dec.

Union dues assessments and initiation fees are allowable business expenses if one or both of the following is true.

Union Professional And Other Dues For Medical Residents Md Tax

2020 Personal Income Tax Return Checklist Caroline And Aschaber Llp

Taxable Benefits Explained By A Canadian Tax Lawyer

The Intricacies Of The 2021 T4 Slip

Tax Brackets Canada 2020 How Tax Brackets Work In Canada

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Frequently Asked Questions Faqs

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Carlson Roberts Seely Llp Alberta Tax Information For Businesses Individuals News

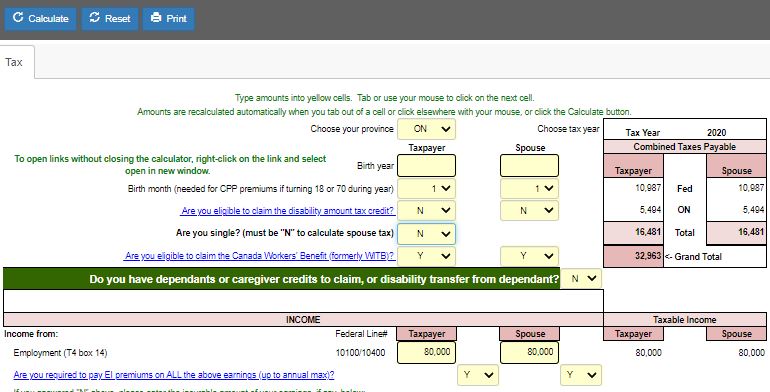

Taxtips Ca 2020 Canadian Income Tax And Rrsp Savings Calculator

2020 Personal Income Tax Return Checklist Caroline And Aschaber Llp

Understanding The Basics Of Tax Sharon Perry Associates Cpa

Carlson Roberts Seely Llp Alberta Tax Information For Businesses Individuals News

Ontario Tax Deductions Credits Tax Lawyer Kalfa Law

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

2020 Year End Tax Tips For Canadians Cloudtax Simple Tax Application